As the world becomes increasingly aware of the urgency of addressing the environmental crisis, many individuals are looking for ways to make a positive impact both socially and financially. Sustainable investing offers an avenue for achieving both goals by investing in companies that prioritize environmental, social, and governance (ESG) factors in addition to seeking financial returns. By integrating ESG factors, investors can align their values with their investment portfolio and contribute to a healthier and more sustainable future.

This post will explore the benefits of sustainable investing, specifically focusing on investing in green energy, socially responsible investing, and impact investing. We will also address common misconceptions and concerns surrounding sustainable investing and offer solutions for overcoming them. Ultimately, we will demonstrate how investing in sustainability can lead to financial wellness while building a brighter future for ourselves and our planet.

Understanding Sustainable Investing: What It Is and How It Can Benefit You.

Sustainable investing, also known as socially responsible investing (SRI), is an investment approach that considers both financial gain and societal impact. It has gained traction in recent years as investors increasingly seek meaningful investments that reflect their values and support positive environmental and social outcomes.

Sustainable investing focuses on three key factors: Environmental, Social, and Governance (ESG) criteria. These are used to assess a company’s environmental impact, treatment of employees and communities, and overall corporate governance practices.

One of the key benefits of sustainable investing is that it can help you align your values with your investments. Rather than solely focusing on financial returns, you can invest in companies that share your values and work towards creating a better world. This means that you can use your money to create positive changes in society and the environment.

In addition to supporting social and environmental causes, sustainable investing can also be financially rewarding. Many studies have shown that companies with strong ESG practices outperform their peers over the long term. This is because they are more likely to have good risk management practices, strong relationships with stakeholders, and better decision-making processes.

It’s important to note that sustainable investing is not a one-size-fits-all approach. Different investors may have different priorities, and it’s important to work with a financial advisor or do your own research to find investments that align with your specific values and goals.

By incorporating sustainable investing into your portfolio, you can not only benefit financially but also support positive social and environmental outcomes. So why not consider investing in a more sustainable future?

Sustainable investing focuses on three key factors: Environmental, Social, and Governance (ESG) criteria.

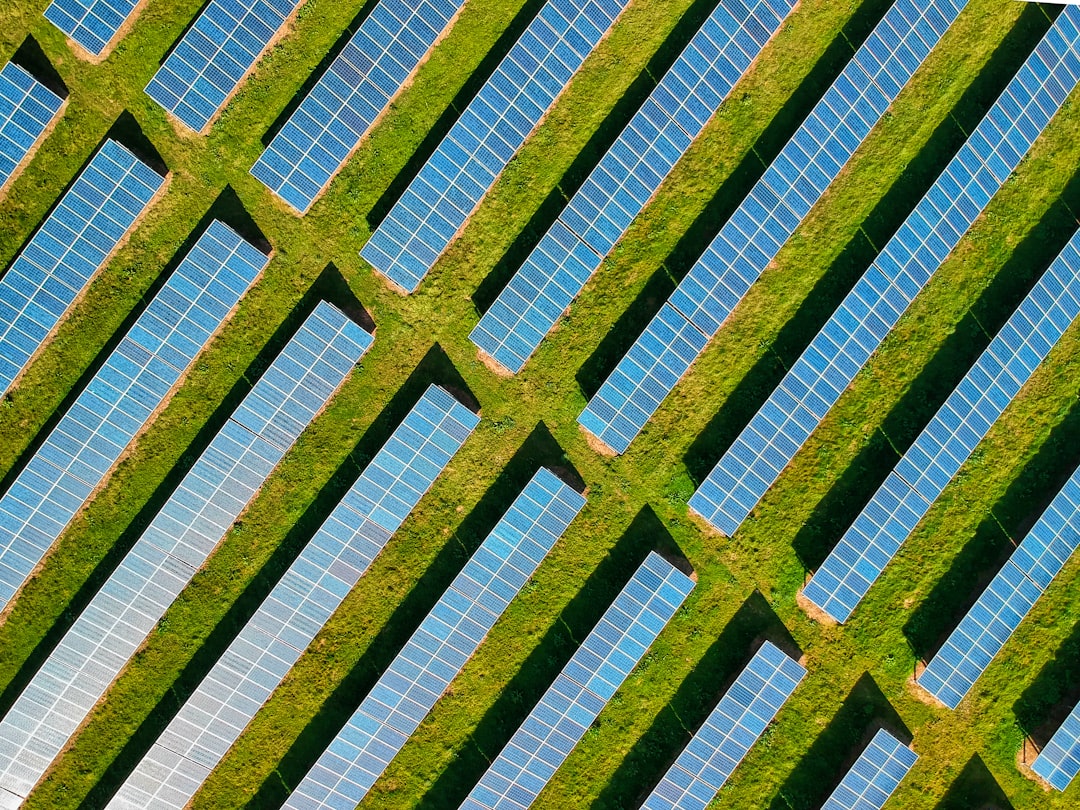

The Power of Investing in Green Energy: The Environmental and Financial Impact

Renewable energy is gaining momentum as a viable alternative to traditional fuel sources like oil and gas, and with good reason. Investing in green energy has proven to be not only environmentally responsible but also financially rewarding. Here’s why:

- Reduced Environmental Impact: Green energy produces considerably fewer greenhouse gas emissions than traditional energy sources. By investing in companies that promote or develop renewable energy, you are indirectly contributing to reducing air pollution and mitigating the effects of climate change.

- Increased Energy Independence: Investing in green energy promotes energy independence by reducing reliance on imported fossil fuels. The more we invest in renewable energy technologies, the less we have to rely on foreign sources of oil and gas, which also makes our energy supply more secure.

- Lower Operational Costs: In addition to its environmental benefits, green energy has also proven to be financially rewarding. Recent studies have shown that investing in renewable energy can lead to significant cost savings in the long run. For example, installing solar panels on a property can lead to significant reductions in energy bills over time, resulting in substantial savings over the course of several years.

- Increased Investment Opportunities: Investing in green energy also presents investors with a wide range of investment opportunities. From renewable energy companies to clean technology firms, there’s no shortage of options for investors interested in putting their money behind companies that promote sustainability and environmental responsibility.

Investing in green energy is not only good for the planet but also for your wallet. So, why not take advantage of this win-win opportunity and invest in a sustainable future?

Investing in green energy is not only good for the planet but also for your wallet.

Socially Responsible Investing: Aligning Your Values with Your Portfolio

Socially responsible investing (SRI) is an investment strategy that integrates environmental, social, and governance (ESG) factors into the investment decision-making process. It enables investors to align their values with their portfolio and invest in companies that are contributing to positive social and environmental outcomes.

SRI has gained popularity over the years as investors increasingly look to make a positive impact with their money. According to a report by the Global Sustainable Investment Alliance, sustainable investing assets reached $30.7 trillion in 2018, up 34% from 2016. SRI is not just a feel-good investment strategy; it also has the potential to deliver financial returns over the long-term.

One approach to SRI is exclusionary screening that involves avoiding certain companies or industries that do not align with an investor’s values. For example, an investor may choose to exclude companies that engage in activities like tobacco, gambling, or weapons manufacturing. Another approach is positive screening, whereby investors actively seek out companies that are making positive contributions to society or the environment. These companies may include those that are involved in clean energy, sustainable agriculture, or affordable housing.

SRI also involves engaging with companies to encourage them to adopt more sustainable practices. Shareholders can use their voting rights to push companies to disclose their ESG practices, reduce their carbon footprint, or improve their labor practices. Such engagement can lead to positive changes for both the company and society.

Critics of SRI argue that it may lead to lower returns due to the exclusion of certain sectors or companies. However, studies have shown that SRI performance is on-par with, and sometimes even outperforms, traditional investments. In addition, SRI can help mitigate risks associated with ESG factors, such as climate change and labor practices, which can ultimately impact a company’s financial performance.

In conclusion, socially responsible investing is a viable investment strategy that allows investors to align their values with their portfolio. It has the potential to deliver long-term financial returns while contributing to positive social and environmental outcomes. As more investors look to make a positive impact with their investment dollars, SRI is likely to continue to grow and evolve.

Critics of SRI argue that it may lead to lower returns due to the exclusion of certain sectors or companies.

Impact Investing: Making a Difference with Your Dollars

Impact investing is all about making a positive difference in the world. By investing in companies that actively seek to make a positive impact on society and the environment, you can use your dollars to support positive change.

When you invest in impact-driven companies, you are channeling funds towards enterprises that work to benefit everyone, not just a select few. Such investments aim to break down economic, social, and environmental barriers while promoting sustainable approaches to industry, agriculture, and other fields.

You might choose to invest in companies that are developing innovative solutions to climate change, promoting social equality, or advancing global health initiatives. With a focus on social and environmental responsibility, impact investing supports the development of companies that create positive change and help build a better future for all.

Importantly, impact investing is not just about doing good; it can be a wise financial decision that can also provide a good return on investment. Many impact-driven companies are innovative start-ups with huge potential for growth, meaning there is a real potential for investors to benefit financially, while also making a positive difference.

However, it’s crucial to note that impact investing requires diligence and research to ensure your investments align with your values and deliver the returns you expect. Investing in impact-driven companies is not necessarily a guaranteed path to success, but it can be a rewarding way to support causes that matter to you.

Overall, impact investing offers a unique opportunity for investors to support positive change through their investment choices. By investing in companies that focus on creating measurable social and environmental returns, you can not only create positive change in the world but also make a significant difference with your dollars.

You might choose to invest in companies that are developing innovative solutions to climate change, promoting social equality, or advancing global health initiatives.

Overcoming Hurdles: Addressing Concerns and Misconceptions About Sustainable Investing

Investing in sustainable funds may seem like a new and untested approach, but the reality is that it has been around for decades. However, some people still harbour misconceptions about sustainable investing and fear that it may not be a suitable investment strategy for them.

One common misconception is that sustainable investing offers lower returns compared to traditional investments. However, studies have shown that sustainable investing can deliver returns that are comparable or even higher than traditional investments. In fact, companies that place a strong emphasis on sustainability tend to be better performers financially.

Another concern is that sustainable investing is too costly. While it is true that some sustainable funds may charge slightly higher fees, this is often offset by the long-term benefits of investing in sustainable funds. For instance, investing in renewable energy through sustainable funds can result in significant savings on energy costs in the long run.

One more hurdle that deters some people from sustainable investing is the perception that it may be too complicated. However, sustainable investing can be as straightforward as traditional investing. There are many resources available to help investors gain the knowledge they need to make informed decisions.

Additionally, some people are hesitant to invest in sustainable funds due to a lack of diversity in the companies available. However, there is a growing number of companies that are incorporating sustainability into their strategies. As the demand for sustainable investing grows, the number of companies being added to sustainable funds will continue to increase.

In conclusion, sustainable investing is a powerful tool for achieving financial wellness while making a positive impact on the planet. Overcoming the hurdles and misconceptions associated with sustainable investing is essential to realizing these benefits. Sustainable investing has become an increasingly mainstream investment strategy, and it is likely to continue its trajectory as investors seek to align their values with their portfolios.

Conclusion: Investing in a Sustainable Future

After exploring the various aspects of sustainable investing, it’s clear that this approach not only benefits your personal financial wellness but also contributes to a brighter and more stable future for the planet.

Investing in sustainable options like green energy, socially responsible companies, and impact-focused funds can all have a positive impact on the environment, society, and the economy. Not only do these investments align with your values and personal goals, but they also help build a more sustainable future for generations to come.

By investing in sustainable options, you’re supporting companies that prioritize environmental and social responsibility, encouraging other organizations to follow suit. This helps to drive positive change across various industries, leading to a more sustainable and just future for all.

While it’s important to acknowledge concerns and misconceptions surrounding sustainable investing, it’s clear that there are options available for everyone. Whether you’re a novice investor or have been in the game for years, there are a variety of funds and companies that cater to a range of risk appetites and investment goals.

By investing in sustainable options, you’re not only bettering your financial future but also contributing to a better world. So why not make the switch to sustainable investing and be part of the movement towards a sustainable and just future?