When it comes to managing your finances, one of the most crucial tools at your disposal is budgeting. Budgeting is the process of creating a plan for how you will allocate your income towards various expenses and savings goals. It provides you with a clear roadmap for your financial journey, helping you make informed decisions about your spending and saving habits. In this blog post, we will explore the importance of budgeting, how to set financial goals, track expenses, create a budget plan, and visualize your budget. By following these steps, you can take control of your finances and work towards achieving your financial goals.

Importance of Budgeting

One of the most crucial aspects of personal finance management is budgeting. Budgeting is the process of creating a plan for how you will spend your money over a certain period of time. It involves tracking your income and expenses, setting financial goals, and making informed decisions about where your money should go. Budgeting is essential for several reasons:

- Financial Stability: Budgeting helps you ensure that you are living within your means and not overspending. By tracking your expenses and income, you can avoid going into debt and maintain financial stability.

- Goal Setting: Budgeting allows you to set financial goals and work towards achieving them. Whether you want to save for a vacation, pay off debt, or buy a new car, having a budget in place can help you allocate your resources effectively.

- Emergency Preparedness: By budgeting and saving for unexpected expenses, such as medical emergencies or car repairs, you can build a financial safety net to protect yourself in times of need.

- Debt Management: Budgeting can help you pay off existing debts faster by allocating extra funds towards debt repayment. By prioritizing debt repayment in your budget, you can become debt-free sooner.

- Financial Awareness: Budgeting increases your financial awareness by giving you a clear picture of your financial situation. You can see where your money is going, identify areas where you can cut back, and make informed decisions about your spending habits.

Overall, budgeting is a powerful tool that can help you take control of your finances, achieve your financial goals, and build a secure financial future. It is the foundation of a strong financial plan and is essential for long-term financial success.

Budgeting is the process of creating a plan for how you will spend your money over a certain period of time.

Setting Financial Goals

Setting financial goals is a crucial step in the budgeting process. It allows individuals to have a clear direction and purpose for their money management efforts. By establishing specific financial goals, individuals can prioritize their spending and saving decisions, ultimately leading to a more successful financial future.

When setting financial goals, it is important to make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Specific goals provide clarity and focus, while measurable goals allow individuals to track their progress and stay motivated. Achievable goals ensure that individuals do not become discouraged, while relevant goals align with their overall financial objectives. Time-bound goals establish a deadline for achieving them, creating a sense of urgency and accountability.

Financial goals can vary widely depending on individual circumstances and priorities. Common financial goals include saving for retirement, purchasing a home, paying off debt, building an emergency fund, or funding a child’s education. By identifying and prioritizing these goals, individuals can allocate their resources effectively and make informed financial decisions.

In addition to setting long-term financial goals, individuals should also establish short-term goals to keep them on track. Short-term goals can include reducing discretionary spending, increasing savings contributions, or paying off a specific debt. By breaking down larger financial goals into smaller, manageable tasks, individuals can make consistent progress towards their objectives.

Overall, setting financial goals is an essential component of the budgeting process. It provides individuals with a roadmap for their financial journey, guiding their decision-making and helping them achieve long-term financial success. By following the SMART criteria and regularly reviewing and adjusting their goals, individuals can stay motivated and focused on their financial objectives.

Short-term goals can include reducing discretionary spending, increasing savings contributions, or paying off a specific debt.

Tracking Expenses

One of the key components of effective budgeting is tracking expenses. Without a clear understanding of where your money is going, it can be challenging to make informed decisions about how to allocate your funds. Tracking expenses allows you to see exactly how much you are spending in different categories, such as housing, transportation, groceries, entertainment, and more.

There are several ways to track your expenses, depending on your preferences and lifestyle. Some people prefer to use a pen and paper to jot down every purchase they make, while others utilize budgeting apps or software to automatically categorize their expenses. Whichever method you choose, the important thing is to consistently track your spending so that you have an accurate picture of your financial habits.

By tracking your expenses, you can identify areas where you may be overspending and make adjustments accordingly. For example, if you notice that you are spending a significant amount of money on dining out each month, you may decide to cut back on restaurant meals and cook more meals at home. Tracking expenses also allows you to monitor your progress towards your financial goals and make any necessary course corrections along the way.

Overall, tracking expenses is an essential part of the budgeting process that can help you take control of your finances and make more informed decisions about how to manage your money. By staying organized and disciplined in tracking your expenses, you can set yourself up for financial success in the long run.

For example, if you notice that you are spending a significant amount of money on dining out each month, you may decide to cut back on restaurant meals and cook more meals at home.

Creating a Budget Plan

Once you have tracked your expenses and set your financial goals, the next step is to create a budget plan. A budget plan is a detailed outline of how you will allocate your income to cover your expenses and reach your financial goals. It serves as a roadmap for your financial journey, helping you stay on track and make informed decisions about your money.

When creating a budget plan, start by listing all of your sources of income, including your salary, bonuses, side hustles, and any other sources of money. Next, list all of your fixed expenses, such as rent, utilities, and loan payments. Then, list your variable expenses, such as groceries, entertainment, and transportation costs. Be sure to include savings and investments as expenses in your budget plan, as these are crucial for building wealth and achieving financial security.

After listing your income and expenses, calculate the difference to determine if you have a surplus or a deficit. If you have a surplus, consider allocating the extra money towards your financial goals, such as paying off debt, saving for a big purchase, or investing for the future. If you have a deficit, look for areas where you can cut back on expenses or increase your income to balance your budget.

It’s important to review and adjust your budget plan regularly to reflect changes in your financial situation and goals. By staying proactive and flexible with your budget, you can adapt to unexpected expenses or income fluctuations and continue making progress towards your financial objectives.

Remember, creating a budget plan is a crucial step in taking control of your finances and achieving financial success. By outlining your financial priorities and allocating your resources accordingly, you can make informed decisions about your money and work towards a secure and prosperous future.

Then, list your variable expenses, such as groceries, entertainment, and transportation costs.

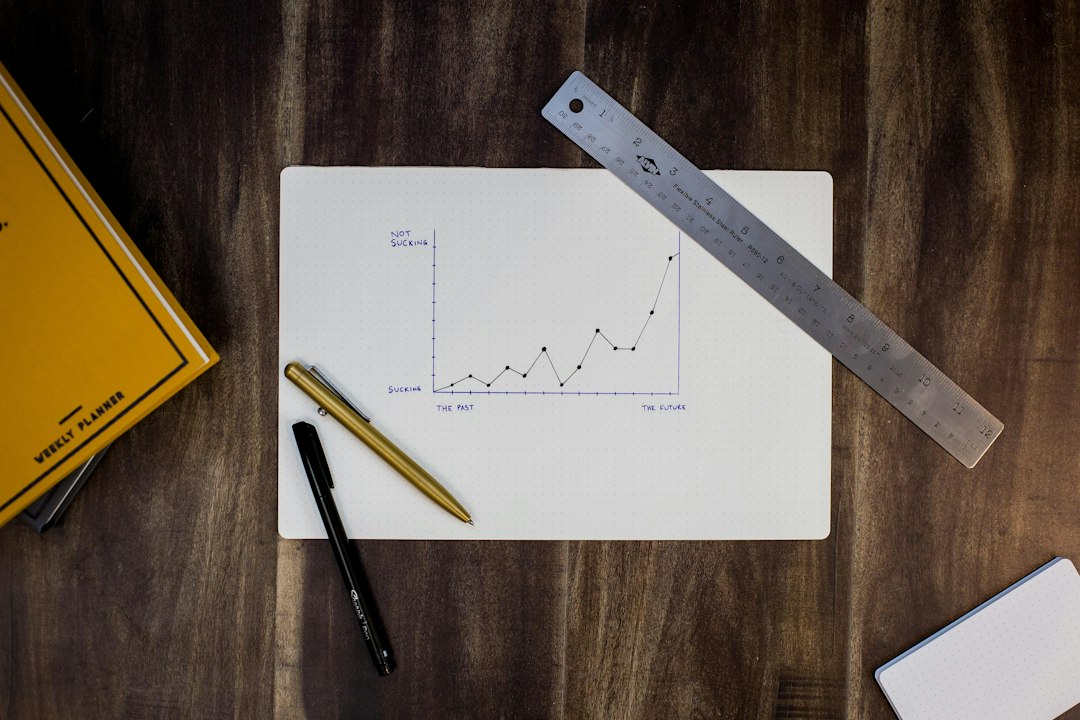

Visualizing Your Budget

Once you have created a budget plan and started tracking your expenses, it’s important to visualize your budget to get a clear understanding of where your money is going and how you can make adjustments to meet your financial goals. There are several ways to visualize your budget, depending on your preferences and needs.

1. Budgeting Apps

There are many budgeting apps available that can help you visualize your budget in a user-friendly way. These apps allow you to input your income and expenses, categorize your spending, and track your progress towards your financial goals. Some apps even offer visual representations of your budget, such as graphs and charts, to help you see where your money is going at a glance.

2. Spreadsheet Programs

If you prefer a more hands-on approach, you can use spreadsheet programs like Microsoft Excel or Google Sheets to create your own budget visualization. You can customize your budget spreadsheet to include categories for different types of expenses, track your spending over time, and create graphs and charts to analyze your financial data.

3. Bullet Journaling

For those who enjoy a more creative approach to budgeting, bullet journaling can be a fun and effective way to visualize your budget. You can create custom layouts in your bullet journal to track your income, expenses, savings goals, and more. By incorporating colors, stickers, and other design elements, you can make your budget visually appealing and easy to understand.

4. Vision Boards

Another creative way to visualize your budget is to create a vision board that represents your financial goals and aspirations. You can cut out pictures from magazines or print images from the internet that symbolize what you want to achieve with your money, such as buying a house, taking a dream vacation, or saving for retirement. By displaying your vision board in a prominent place, you can stay motivated and focused on your financial goals.

By visualizing your budget in a way that resonates with you, you can gain a better understanding of your financial situation, identify areas where you can make improvements, and stay on track towards achieving your financial goals.

You can customize your budget spreadsheet to include categories for different types of expenses, track your spending over time, and create graphs and charts to analyze your financial data.

Conclusion

Throughout this blog post, we have discussed the importance of budgeting and how it plays a crucial role in achieving financial stability and success. By understanding the significance of budgeting, setting financial goals, tracking expenses, creating a budget plan, and visualizing your budget, individuals can take control of their finances and work towards achieving their financial aspirations.

It is essential to recognize that budgeting is not a one-time task but a continuous process that requires diligence and discipline. By regularly reviewing and adjusting your budget, you can ensure that you are on track to meet your financial objectives and make informed decisions about your spending habits.

Remember, budgeting is a tool that empowers you to make informed financial decisions, prioritize your expenses, and save for the future. By taking control of your finances through budgeting, you can reduce financial stress, build wealth, and achieve your long-term financial goals.

So, start budgeting today and take the first step towards financial freedom and security. Your future self will thank you for the financial discipline and foresight you demonstrate today.