As an entrepreneur, your ability to effectively pitch your business idea can be the difference between success and failure. A successful pitch can help you secure the funding you need to take your business to the next level, while a poor pitch can leave you without the resources to move forward.

Pitching your business idea is not just about presenting your product or service to potential investors. It’s about telling a story that captures their attention, sparks their imagination, and convinces them that your business has the potential for success.

In today’s highly competitive business world, having a successful pitch is crucial. Investors are inundated with pitches every day, and you need to stand out from the crowd if you want to secure the funding you need to grow your business.

The good news is that crafting a successful pitch is a skill that can be learned and refined over time. By following a structured approach, and focusing on the key elements of your business that investors care about, you can create a pitch that is both compelling and convincing.

In this blog post, we’ll walk you through the key steps involved in crafting a successful pitch. From researching the right investors, to crafting a compelling narrative, to designing a dynamic pitch deck, we’ll cover everything you need to know to make your pitch a success. So let’s get started!

Setting the Stage: Researching the Right Investors

As an entrepreneur or startup founder, it’s essential to find the right investors to help you grow your business. But how do you know which investors to approach? The first step is to do your research.

Start by identifying potential investors who have experience in your industry or niche. Look at their investment portfolio to see if they’ve invested in similar businesses. This will give you an idea of whether or not they would be a good fit for your company.

It’s also important to consider the stage of your business. Are you just starting out, or are you looking for funding to take your business to the next level? Different investors specialize in different stages of a company’s growth, so make sure you’re targeting the right ones.

Once you’ve identified potential investors, it’s time to do some deeper research. Look into their background, their investment philosophy, and their track record. Do they have a reputation for working well with entrepreneurs, or are they known for being difficult to work with?

You may also want to consider the location of the investor. Are they local, or do they invest primarily in other parts of the country or world? This can impact their level of interest in your business, as well as the amount of time and effort it will take to build a relationship with them.

Finally, don’t forget to consider the financial aspects of the investment. How much money are they willing to invest, and what kind of return are they expecting? Are they looking for a quick exit, or are they willing to be patient and help you grow your business over the long term?

By doing your research and targeting the right investors, you’ll be well on your way to crafting a successful pitch and securing the funding you need to take your business to the next level. So take the time to set the stage and identify the right investors, and you’ll be one step closer to achieving your entrepreneurial goals.

Are they looking for a quick exit, or are they willing to be patient and help you grow your business over the long term?

Crafting Your Story: A Compelling Narrative is Key

Crafting a compelling narrative is the heart of any successful pitch. It’s not just about presenting a great idea; it’s about telling a story that captures the imagination and resonates with your audience. When done right, a great story can turn a skeptical investor into a passionate advocate.

The key to crafting a compelling narrative is to understand your audience. You need to know who they are, what they care about, and what motivates them. Once you have this information, you can tailor your story to their interests and needs.

Start by defining your core message. What is the big idea that you want to convey? What problem are you solving, and why is your solution better than the competition? Once you have your core message, you can begin to build your story around it.

A great storytelling technique is to use a hero’s journey framework. This is a classic narrative structure that follows a hero as they face challenges and overcome obstacles. In your pitch, you can position your product or service as the hero, and show how it overcomes challenges and solves problems for your customers.

Another key element of a great story is emotion. You need to create an emotional connection with your audience, so they become invested in your success. This can be done by sharing personal anecdotes, or by highlighting the impact your product or service will have on society.

Finally, make sure your story is authentic. Investors can spot a fake story from a mile away, so make sure that everything you say is true and backed up by data. If you can show that you have a solid business plan and a track record of success, investors will be more likely to take a chance on you.

Crafting a compelling narrative is key to any successful pitch. By understanding your audience, defining your core message, using a hero’s journey framework, creating an emotional connection, and being authentic, you can create a story that captures the imagination and inspires action. So, get to work on crafting your story and watch as your pitch takes flight!

In your pitch, you can position your product or service as the hero, and show how it overcomes challenges and solves problems for your customers.

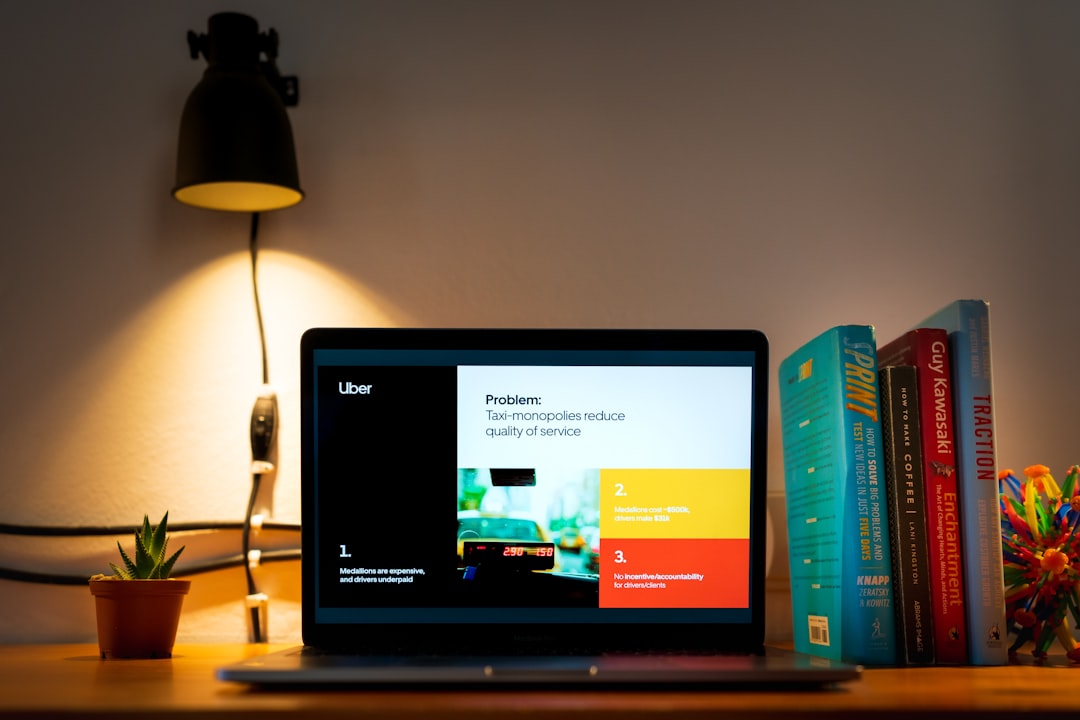

Building Your Pitch Deck: Designing a Dynamic Presentation

As the saying goes, you never get a second chance to make a first impression. When it comes to pitching your business idea to investors, your pitch deck is the visual representation of your narrative. It should be designed in a way that captures your audience’s attention, keeps them engaged throughout the presentation, and leaves a lasting impression.

To build a dynamic pitch deck, you must first understand what information is essential to include. Ideally, your deck should be ten to fifteen slides long and should cover the following topics:

– Company Overview: Give a brief introduction to your company and explain what it does.

– Problem and Solution: Describe the problem you are trying to solve and how your business solves it.

– Market Size and Opportunity: Provide data on the market size and opportunity for your product or service.

– Business Model: Explain how your company generates revenue and what makes it unique.

– Marketing and Sales Strategy: Outline your marketing and sales plans.

– Team: Introduce your team and their expertise.

– Financials: Present your financial projections and explain how you plan to use the funds you are seeking.

– Ask: State how much funding you are seeking and what you will do with it.

Once you have determined the content for your pitch deck, it is time to design it. Your pitch deck should be visually appealing and easy to read. You should use a consistent color scheme and typography throughout the deck. Make sure that your font size is large enough to be read from a distance.

Visual aids such as charts, graphs, and images should be used sparingly and only when they add value to the presentation. They should be easy to read and understand quickly.

Finally, practice your pitch deck several times before presenting it to investors. Make sure that you can deliver it smoothly and confidently. Rehearse your presentation with a friend, mentor, or coach who can provide feedback on how to improve it.

Building a dynamic pitch deck is an important part of the pitching process. It should be designed to capture your audience’s attention, keep them engaged, and leave a lasting impression. With a well-crafted pitch deck, you will be one step closer to securing funding for your business.

Make sure that your font size is large enough to be read from a distance.

Preparing for the Meeting: Practice Makes Perfect

As the saying goes, practice makes perfect. And this couldn’t be truer when it comes to preparing for a pitch meeting with investors. The more you rehearse your pitch, the more confident and polished you’ll appear when meeting with potential investors.

First and foremost, make sure you’ve memorized your pitch. While it’s important to have your pitch deck on hand as a visual aid, you should be able to deliver your pitch without relying solely on the presentation. This will help you come across as genuine and knowledgeable about your business.

Next, consider setting up mock pitch meetings with friends, family, or colleagues. This will allow you to get feedback on your presentation and delivery, as well as help you identify any areas that may need improvement. It’s important to remember that practice isn’t just about perfecting your pitch, but also about being able to handle unexpected questions or objections that may arise during the meeting.

In addition to rehearsing your pitch, make sure you’re well-versed in your business and industry. Researching potential investors and their interests can also help you tailor your pitch to their specific needs and expectations. This demonstrates that you’ve done your homework and are invested in building a long-term relationship with them.

Lastly, don’t forget to prepare yourself mentally and physically for the meeting. Get plenty of rest, eat a healthy meal beforehand, and dress professionally. These small details can make a big difference in how you come across to potential investors.

Remember, the goal of preparing for a pitch meeting isn’t just to impress investors, but also to build confidence in yourself and your business. By practicing and preparing thoroughly, you’ll be in a strong position to land the investment you need to take your business to the next level.

These small details can make a big difference in how you come across to potential investors.

The Pitch Itself: Dos and Don’ts for Success

As you step into the meeting room with potential investors, it’s natural to feel a mix of excitement and nerves. You’ve put in the work to research the right investors, craft a compelling narrative, and design a dynamic presentation. Now it’s time to deliver your pitch and seal the deal. Here are some dos and don’ts to keep in mind:

Do:

- Start with a strong hook that captures your audience’s attention and piques their interest. This could be a surprising statistic, a personal story, or a bold statement that sets the stage for what’s to come.

- Focus on the problem you’re solving and how your product or service is uniquely positioned to address it. Be specific about the pain points your target market is experiencing and how you plan to solve them.

- Show, don’t tell. Use visuals, prototypes, and demos to illustrate your key points and bring your pitch to life. This will help investors visualize the potential of your product or service and make it more tangible.

- Be confident and passionate about your idea. Investors want to see that you believe in your product or service and that you’re committed to making it a success.

- Be prepared for tough questions and objections. Anticipate the most common questions and concerns investors might have and have thoughtful, data-driven answers ready.

Don’t:

- Ramble or go off on tangents. Stick to your main points and keep your pitch concise and focused.

- Oversell or exaggerate. Be honest about the potential of your product or service and avoid making unrealistic claims.

- Assume that the investors know all the technical jargon or industry-specific terms. Make sure to explain any complex concepts in simple, easy-to-understand language.

- Forget to include a clear ask. Be specific about what you’re looking for from the investors, whether it’s funding, strategic advice, or connections to industry contacts.

- Get defensive or argumentative if investors raise concerns or objections. Instead, listen carefully to their feedback and use it as an opportunity to show how you’ve thought through potential challenges.

Remember, the pitch itself is just one piece of the puzzle when it comes to securing funding and building a successful business. But by following these dos and don’ts, you’ll be more likely to make a strong impression and move one step closer to achieving your goals.

This will help investors visualize the potential of your product or service and make it more tangible.

Conclusion: Following Up and Moving Forward

Congratulations! You have successfully pitched your business idea to potential investors. But the journey doesn’t end here. Following up with investors is just as important as the pitch itself. It shows your commitment and professionalism, and it keeps the conversation going.

After the pitch, it’s good practice to send a follow-up email to the investors thanking them for their time and interest. In the email, you can also provide additional information that may not have been covered in the pitch or answer any questions that were asked during the meeting.

Be sure to keep the conversation flowing by staying in touch with the investors regularly. This can be through periodic updates on your progress or by reaching out with any questions or concerns you may have.

It’s essential to remember that not all investors will be interested in your business idea, and that’s okay. It’s crucial to take feedback constructively and work on improving your pitch and business model. Keep refining your approach and keep trying until you find the right investors who believe in your vision.

Moving forward, continue to network and develop relationships with potential investors. Attend industry events, join entrepreneur groups, and seek mentorship opportunities. Staying connected to the startup community can lead to new opportunities and valuable connections.

Pitching your business idea is just the beginning of a long journey to success. But with the right approach, practice, and persistence, you can turn your idea into a thriving business. Keep innovating, stay adaptable, and always keep your goals in mind. Good luck on your entrepreneurial journey!